You may want nothing to do with it right now but know that it will soon affect your life.

You don’t need to take my word for it. Just step back and look at the past. We have seen this before. Several times. Every major cultural or industry disruption starts the same way: with pirates defying social norm – and many times the law – for a reason, for an ideal (For a truly interesting reading on the topic: The Pirate’s Dilemma, a book by Matt Mason).

We have seen Napster bring P2P file sharing to the masses. It was eventually forced to shut down as a result of numerous lawsuits but it changed the music industry forever. We have seen this with Uber, who fought (and still is fighting) its way country by country, state by state, city by city, and ultimately was able to change a century old transportation industry. The same with Airbnb, who still faces numerous restrictions, criticism and roadblocks, but has nonetheless changed the hospitality business forever. Or Netflix, who reinvented itself and in the process, revolutionized TV and the movies industry. Or we can go as far as back to the beginning of the last century and use the example of a pirate named William that defied social norm and intellectual property laws by fleeing to the west coast of the United States to continue using filmmaking equipment without respecting patent rights owned by Thomas Edison. In the (still) wild west of the early 1900’s, William thrived and among others, helped develop the movie industry as we know it today. William’s last name was Fox.

These pirates force the rest of society to look at the world through their lenses or to experiment with something in a novel fashion. An initial negative reaction is slowly replaced by resigned acceptance, and soon followed by a race to embrace the new movement before the masses.

We are at this second stage with the blockchain already.

Several countries and many of the major financial institutions have already either fully embraced the concept of the blockchain or have at least a small team assessing its potential and keeping an eye on the market.

The easiest parallel to draw here is with the internet. In the early days of widespread use of the internet, it was still a ‘cool thing’ you could do stuff with, like search for information or reconnect with a high school lost friend. But that was it. In the early 90’s, the internet was something promising but no one was really sure in what way. We are living that moment with blockchain.

Needless to say that bitcoin is the most prominent celebrity of this revolution. The bitcoin blockchain was the responsible for getting the blockchain concept from the realm of ultra-geek ideas and making it mainstream. However, no one knows for how long it will survive. Some believe bitcoin might be the first one through the door – and the first one through the door always gets shot.

Bitcoin’s demise may look unlikely at this point but let us not forget, in the early days of the internet, how amazingly important were Altavista (the search engine), Myspace (social network), Netscape (browser), Yahoo (internet services provider) and later Napster (P2P file sharing). All of them were pioneers and responsible for bringing internet’s usage to the masses, but for one reason or another, are not around anymore. On the other hand, IBM, Apple, Microsoft, Amazon are still around and have resisted well throughout several winters.

In the end, it is irrelevant if bitcoin will ultimately continue to thrive. The most important contribution brought by bitcoin – the concept of the blockchain – is already understood and has a life of its own now.

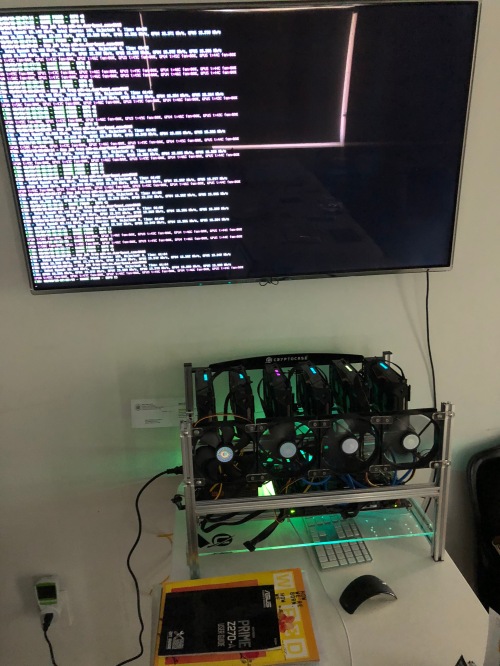

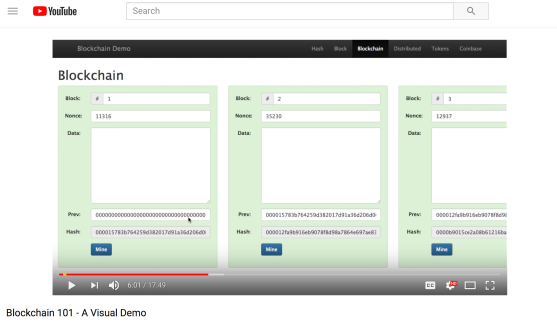

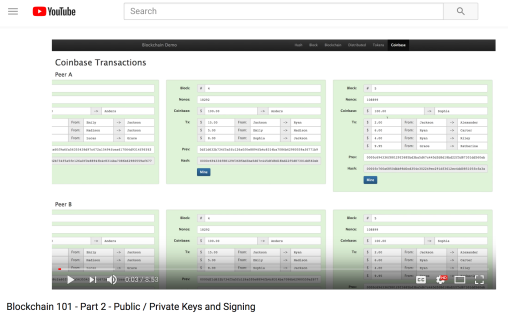

The blockchain concept is still unknown for many – and will probably continue to be. In reality, one does not need to understand the intricacies of blockchain, mining, double spending, byzantine general’s problem, proof of work or proof of stake. As an example, the majority of people does not know what hypertext transfer protocol means even if it the foundation of data communication over the internet – the HTTP letters of almost every internet page in a browser.

There is sometimes too much effort being put on trying to explain the blockchain and trying to understand it. More important than that seems to be a discussion on what are the possible applications. Human beings tend to be more comfortable accepting something with examples rather than with its functionality.

The possible uses for blockchain are numerous, several of which are currently already operating while others are being tested. The main characteristics sought after in blockchains are the trustworthiness of the information resting on it, as well as its (almost) immutability.

Those aspects lead to several ideas related to the removal of the middleman – and when one thinks hard about it, there is a middleman everywhere. Easy examples are real estate registrar’s office, financial institutions being used for payment or transfer of value, identity confirming authority / business, energy utility company between power producers and consumers. The blockchain is even being used to improve farming, as described in this Article by Bennett Garner originally published at coincentral.com.

Another extremely interesting use for blockchains is the feature known as smart contract, which is essentially a more automated and less human dependent way of establishing action/reaction in a business setting, or in other words, an if/then relationship will not depend on a trusted third party to execute the second part of the sequence. For instance, a payment that is dependent on an upcoming event will happen automatically upon the occurrence of that event, instead of depending on a party first acknowledging the event and then taking steps to process payment.

And there is the dream of providing banking for the unbanked. There is still today a relevant portion of population without access to banking services, for a number of reasons. The promise of the blockchain as a means to correct this has been widely publicized but still has to prove itself viable. Blockchains and blockchain services providers also have costs associated with them and, in order to survive, will need to adhere by the same standards of KYC and AML that banks use. That combination of costs and KYC/AML by itself will undoubtedly be a hurdle to this imagined easy access of anyone to banking services associated with a blockchain.

This is at least part of a heated debate between some original pioneers, aka crypto evangelists, and on the other side, the traditional business establishment. The pioneers are mostly libertarians, who view the beauty of the blockchain in its complete isolation from the regulated industry or governments, and who despise any effort of widening adoption through regulation or adherence to existing systems. The other side, the current establishment, is eager to feast on the advantages of the blockchain but is still wary of its unregulated nature and somehow beat up reputation.

Odds seem to be on the ‘the suits’ side. At this point, there is already too much investment, interest and effort focused on working with the blockchain concept and making it successful. There is no turning back. At the same time, governments everywhere are either proactively pursuing regulation or being forced to do something about it.

Today, bad reputation still haunts any crypto related startup. The famous Wired article of 2011 about bitcoin brought the cryptocurrency to light and also forever associated its use with the silk road, the then underworld website for sale of anything illegal, from drugs to non-authorized guns. Since then, the silk road has been long dismantled, many people today understand that there are many more uses for cryptocurrencies than just illegal activity and furthermore, even criminals are more and more realizing that it is a bad idea to use cryptocurrencies for their illegal activities since the aspect of anonymity of the digital tokens is hugely overrated and they are finding – the hard way – that bitcoin-like ransom payments are very much traceable and thus a very bad idea.

Cryptocurrency businesses today are facing a path similar to that of the marijuana business. They are both legal (under certain circumstances, with certain limitations and, for marijuana, only in certain states) but face an overall lack of trust and are seen as a gray area business. Many banks are still refusing to do business with either marijuana or cryptocurrency related companies, or will sometimes close down accounts without much of an explanation.

But the current obstacles are necessary. It is at a minimum expected that a concept as disruptive as the blockchain will have to go through this rite of passage. Especially since one of the most affected industries is the most powerful of them – the banking sector. They will ultimately adhere, adjust and accommodate, but it will be on their own terms and on their own timing. And it is known that the financial sector infrastructure is one of the least updated around. The outer shell sometimes looks brand new but the spine is still pretty much 50 years old.

No one can truthfully predict – although many try – where will this blockchain revolution lead us or even what will the price for Bitcoin be in 6 months. It is nonetheless interesting to have the opportunity to witness the unfolding of the many derivatives of this brilliant concept.

Keep an open eye.

Two weeks ago (on 11/16/2018), the SEC released a Statement on

Two weeks ago (on 11/16/2018), the SEC released a Statement on

3. Byzantines General Problem. If you have spent some reasonable time trying to understand what bitcoin and blockchain is, you have probably heard this expression. It was first used in 1982 (according to

3. Byzantines General Problem. If you have spent some reasonable time trying to understand what bitcoin and blockchain is, you have probably heard this expression. It was first used in 1982 (according to

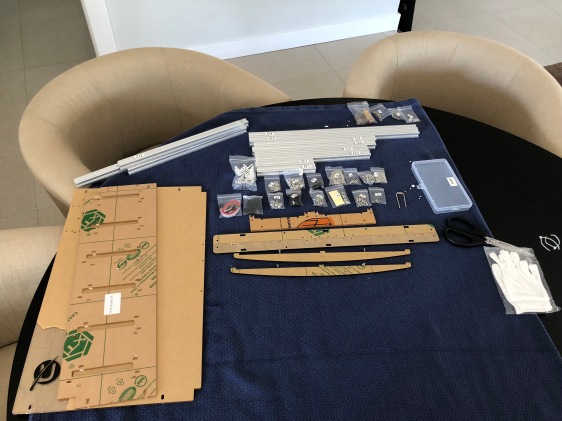

You can choose between a digital wallet (based on software that is installed in your computer) or a physical one (looks like a pen drive). For the digital wallet, I would suggest the free wallet on

You can choose between a digital wallet (based on software that is installed in your computer) or a physical one (looks like a pen drive). For the digital wallet, I would suggest the free wallet on  For a physical/hardware wallet, I would suggest the Trezor. It is still a referred as the gold standard in hardware wallets. It is the one I use and despite not being exactly user friendly, it is supposedly safe. It is obviously harder to move coins back and forth every time you sell, buy or transfer, but it is truly the safer option.

For a physical/hardware wallet, I would suggest the Trezor. It is still a referred as the gold standard in hardware wallets. It is the one I use and despite not being exactly user friendly, it is supposedly safe. It is obviously harder to move coins back and forth every time you sell, buy or transfer, but it is truly the safer option. Do you want to understand blockchains? Learn about bitcoin in plain English? Navigate the basic concepts of the cryptocurrency world? I have been trying those things too, for almost 2 years now.

Do you want to understand blockchains? Learn about bitcoin in plain English? Navigate the basic concepts of the cryptocurrency world? I have been trying those things too, for almost 2 years now.

Anyone following the financial market or news about cryptocurrencies is faced on a daily basis with predictions by “experts” on the future price of a certain cryptocurrency.

Anyone following the financial market or news about cryptocurrencies is faced on a daily basis with predictions by “experts” on the future price of a certain cryptocurrency.