Do you want to understand blockchains? Learn about bitcoin in plain English? Navigate the basic concepts of the cryptocurrency world?

I have been trying those things too, for almost 2 years now.

In this part 2 of the post, I want to share some additional fonts of information, in case you want to dig deeper than just the surface.

FYI – Again, I have no interest (personal or commercial) in promoting the links on this post. This is just my honest sharing of the most useful things that I have bumped into.

1. Podcasts about cryptocurrencies and blockchains. It is impossible to hear them all. But from what I have seen, here is what I thought is worth sharing:

Unchained. A podcast by Forbes reporter Laura Shin. She has been able to interview some of the most relevant people in the crypto space and has fostered some interesting debate.

Unchained. A podcast by Forbes reporter Laura Shin. She has been able to interview some of the most relevant people in the crypto space and has fostered some interesting debate.

The Tim Ferris Show. Episode 244. Interview with Nick Szabo. The Quiet Master of Cryptocurrency. It is a long interview with lots of useful information. Nick has a very relevant place in the crypto world.

The Tim Ferris Show. Episode 244. Interview with Nick Szabo. The Quiet Master of Cryptocurrency. It is a long interview with lots of useful information. Nick has a very relevant place in the crypto world.

2. Wired famous 2011 article. A lot of people first became aware of bitcoin in 2011 because of this Wired magazine article. It is mentioned very often and became part of the general reference on the subject.

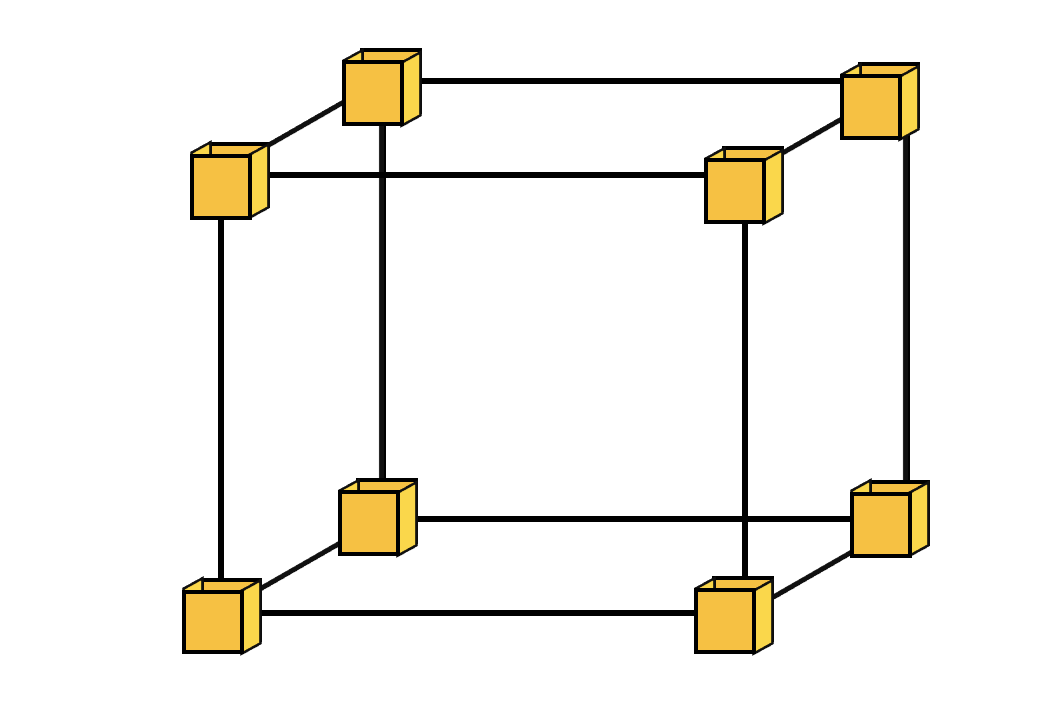

3. Byzantines General Problem. If you have spent some reasonable time trying to understand what bitcoin and blockchain is, you have probably heard this expression. It was first used in 1982 (according to this wikipedia article) to describe a problem with trust in networked computers coordination. The Bitcoin white paper by Satoshi Nakamoto I referred to in part 1 of this post brought an elegant solution that generates trust in the network of people validating the ledger of transactions of a certain cryptocurrency. In summary, the software is built in such a way that it is too hard, too expensive and almost useless to try to defraud the ledger, because of the amount of computer work that has to be performed within a short period of time. It took me some time to find this excellent explanation by Doug Campbell. It is straight forward and easy to understand by someone that is not a techie.

3. Byzantines General Problem. If you have spent some reasonable time trying to understand what bitcoin and blockchain is, you have probably heard this expression. It was first used in 1982 (according to this wikipedia article) to describe a problem with trust in networked computers coordination. The Bitcoin white paper by Satoshi Nakamoto I referred to in part 1 of this post brought an elegant solution that generates trust in the network of people validating the ledger of transactions of a certain cryptocurrency. In summary, the software is built in such a way that it is too hard, too expensive and almost useless to try to defraud the ledger, because of the amount of computer work that has to be performed within a short period of time. It took me some time to find this excellent explanation by Doug Campbell. It is straight forward and easy to understand by someone that is not a techie.

4. Crypto Wallets. If you ever decide to invest in bitcoin, ethereum or whatever other cryptocurrency, you should keep your assets in a digital wallet. For most of us, it is a counterintuitive suggestion. We always learned that we should keep our assets safe in the bank and not at home in our mattresses. Time to go back to the mattress.

Whenever you open an account with an exchange, the exchange will offer to hold your assets for free (like banks will keep your money), but you do not want to do that. Exchanges are (i) vulnerable to hacking (that was the case of MtGox – at the time it was the biggest exchange), and (ii) subject to government intervention, or the exchange may just decide to freeze your account until you are able to prove you are not that person with the same name that use bitcoin for online gambling (it happens). There are tons of options for digital wallets in the market today.

You can choose between a digital wallet (based on software that is installed in your computer) or a physical one (looks like a pen drive). For the digital wallet, I would suggest the free wallet on www.blockchain.com.

You can choose between a digital wallet (based on software that is installed in your computer) or a physical one (looks like a pen drive). For the digital wallet, I would suggest the free wallet on www.blockchain.com.

For a physical/hardware wallet, I would suggest the Trezor. It is still a referred as the gold standard in hardware wallets. It is the one I use and despite not being exactly user friendly, it is supposedly safe. It is obviously harder to move coins back and forth every time you sell, buy or transfer, but it is truly the safer option.

For a physical/hardware wallet, I would suggest the Trezor. It is still a referred as the gold standard in hardware wallets. It is the one I use and despite not being exactly user friendly, it is supposedly safe. It is obviously harder to move coins back and forth every time you sell, buy or transfer, but it is truly the safer option.

I hope this has been useful for some of you. I will come back on a later date to share some more info.